How to Calculate Opportunity Cost

The total cost incurred is the sum of your business expenses and the salary you forfeited. Essentially the equation involves.

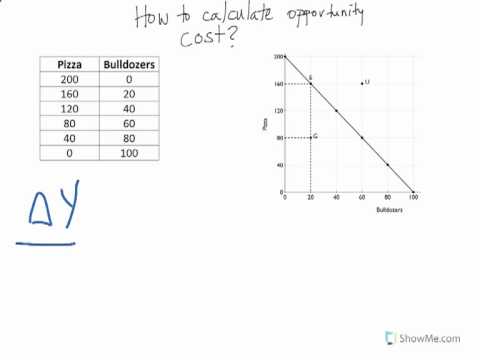

How To Calculate Opportunity Cost Youtube

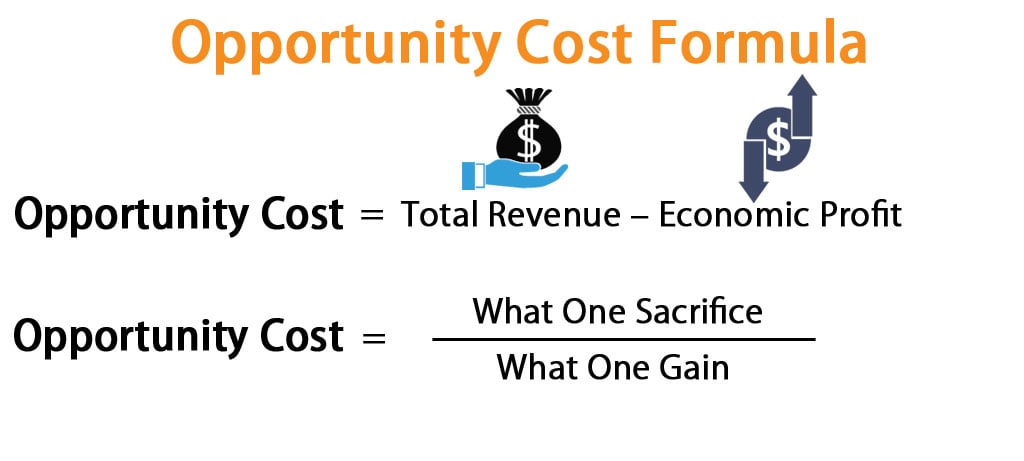

If you cant come to a clear conclusion you can determine your opportunity cost by using a very simple formula.

. In financial analysis the opportunity cost is factored into the present when calculating the Net Present Value formula. To reduce this equation down we divide each side by 25 and this gives us. An investor calculates the opportunity cost by comparing the returns of two options.

Opportunity Cost Formula in Excel With Excel Template Here we will do the same example of the Opportunity Cost formula in Excel. Divide what youll sacrifice by what you stand to gain if you take one job over. Making these choices means being aware of the opportunity cost of them.

This can be done during the decision-making process by estimating future returns. Return on best foregone option FO - return on chosen option CO opportunity cost. What an opportunity costs you is the difference.

Opportunity cost refers to a benefit that a person could have received but gave up to take another course of action. Thats where the opportunity cost formula comes in. The key to understanding how businesses see opportunity costs is to understand the concept of economic profit.

And then reducing it down one more time gives us. Generally opportunity costs involve tradeoffs associated with economic choices. 2 tons of corn 1 ton of beef.

The opportunity cost equation is an important tool for those who wish to make well-informed decisions. The formula is simply the difference between what the expected returns are of each. If you earned a salary of 40K per annum and spent 100K over 2 years on running your business the.

6 10. How to Calculate Opportunity Cost. It is very easy and simple.

This video goes over the process of calculating opportunity costs. Total revenue-economic profit opportunity costs. An opportunity cost formula provides you with a way to measure the difference between two decisions as a way to land on a rough value figure of one option over the other.

In this example you have sacrificed 10000 each month because you did not calculate the opportunity cost of taking on the single client for the 50000 monthly fee. Stated differently an opportunity cost represents an. 1 ton of corn ½.

How to Calculate Opportunity Cost. The opportunity cost is a difference of four percentage points. Opportunity cost Company A Company B.

You can easily calculate the. Now we plug these variables into the formula. However your opportunity cost is the development of important skills that would help you move forward in different aspects of your life.

When you calculate opportunity cost you are simply finding the difference between the two expected returns for each of the options you have.

Opportunity Cost Formula Calculator Excel Template

Calculating Opportunity Cost Youtube

Calculating Opportunity Cost Microeconomics

Opportunity Cost Calculate Opportunity Cost Youtube

0 Response to "How to Calculate Opportunity Cost"

Post a Comment